Things about Empty Home Tax Bc

Table of ContentsThe 6-Minute Rule for Empty Home Tax BcNot known Facts About Empty Home Tax BcSome Known Questions About Empty Home Tax Bc.The Facts About Empty Home Tax Bc UncoveredSome Known Questions About Empty Home Tax Bc.

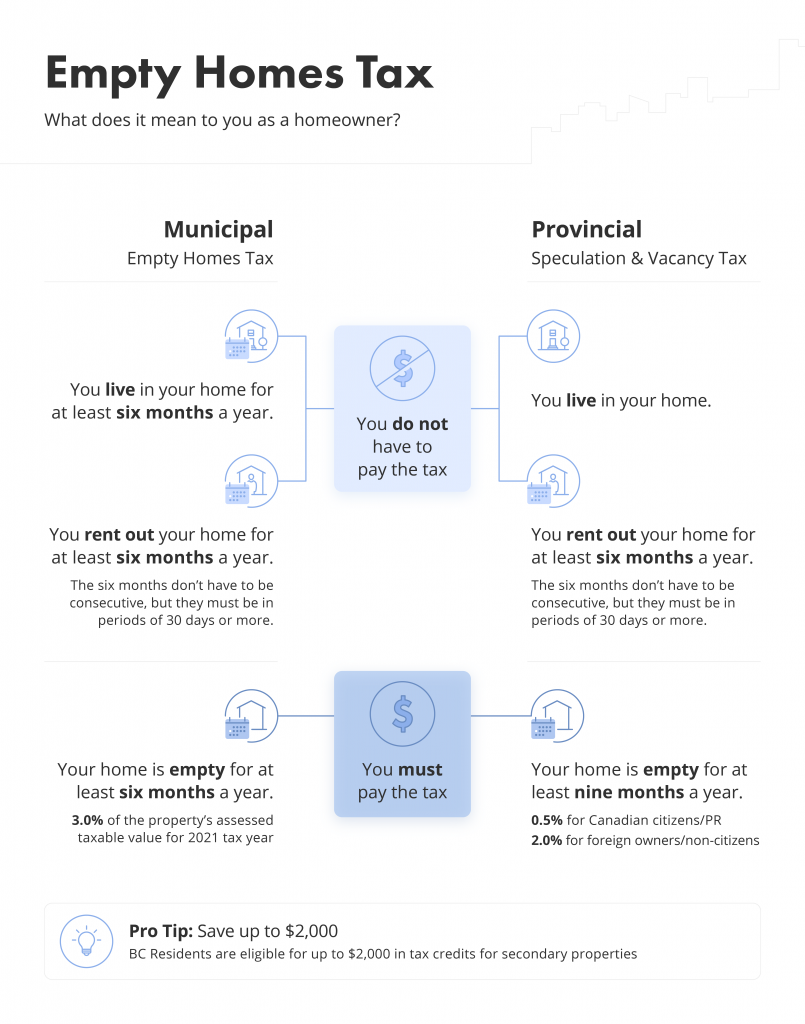

government's conjecture and openings tax obligation. In Vancouver, a homeowner with a second residential property in the city is prone to all three regulations, with the report recommending these plans created solid incentives for an owner to rent out a system long-lasting rather than leaving it uninhabited or leasing it temporary.

Other aspects pointed out that could have added to the increase in supply consist of strong rental demand and also some owners that made considerable resources gains associated with rate recognition of their units selecting to sell (empty home tax bc). Subsequently, new proprietors may have included devices to the long-term rental market that were formerly owner-occupied, vacant, or rented out temporary, the report included.

Empty Home Tax Bc Fundamentals Explained

While the tax obligation motivates owners to rent out buildings, Swanson additionally noted money from the tax $61. 3 million considering that 2017 assistances budget-friendly real estate initiatives. "If individuals are rich sufficient to have an empty home, they're rich sufficient to help offer people that don't have real estate, as well as we definitely need more money for charitable housing and also this is one way to get it," Swanson said.

"It's unusual to see City of Vancouver team not suggesting a tax or fee boost. Raising the vacant houses tax obligation to three per cent was one of Stewart's campaign assures when he ran for mayor in 2018.

By the time we obtained to the point where we were making a choice concerning the empty homes tax obligation, there currently were, I believe, 5 brand-new demand-side steps on supposition and uninhabited homes. So what I assumed would certainly be a bit careless would be to include all that in, and I was fretted about the results on the market." Many homeowners in Vancouver are exempt to the tax because it does not put on principal residences or homes leased for at least 6 months of the year. empty home tax bc.

Rumored Buzz on Empty Home Tax Bc

The non-compliance rate has varied from five percent to 10 per cent. @Howellings. empty home tax bc.

If there ever before was a bill that attempted to attend to the signs of a trouble instead of the reasons, Bill 9 would be it. Presently being considered by the Honolulu Common Council, the costs seeks over here to create more budget friendly real estate on Oahu by straining "empty houses," of which, the costs quotes, there have to do with 34,000.

Not just would the costs be unlikely to achieve its goal, it would enforce extraordinary worries on existing property owners via sky-high tax obligations, a need that they surrender essentially all of their personal privacy legal rights to city detectives, and severe as well as potentially unconstitutional penalties if the home owners were discovered in offense of the proposed regulation.

Facts About Empty Home Tax Bc Revealed

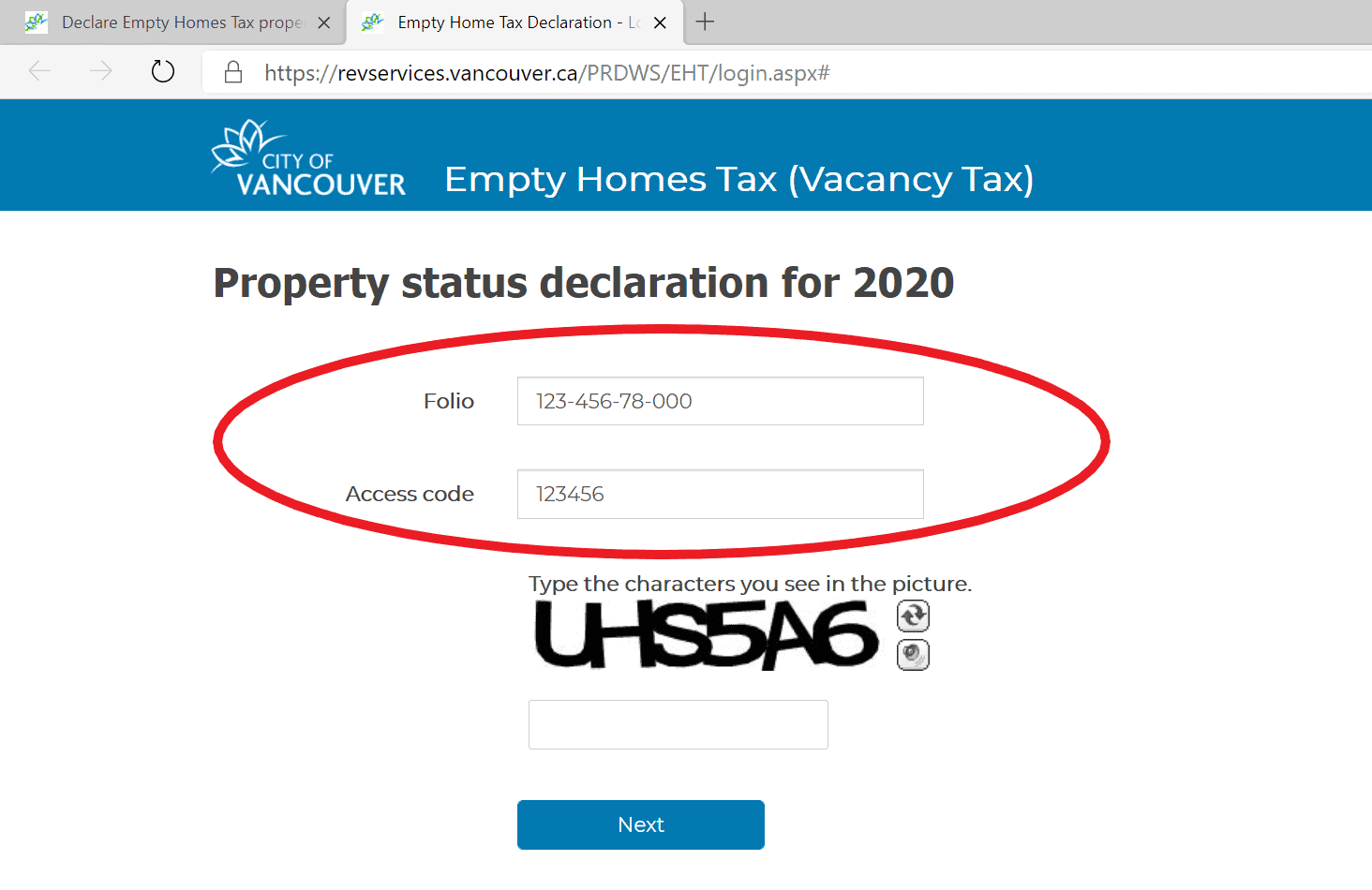

The Vacant Residences Tax obligation likewise referred to as the Openings Tax obligation is for residential or commercial properties in the City of Vancouver considered empty for more than 6 months of the year. Many homes will be excluded if they are primary homes or rented for at the very least 6 months of the year. All owners should make a condition.

00. This is a great deal of cash for majority of the population in Greater Vancouver as well as that's why it is vital to proclaim that your building is excluded from the Vacant House Tax obligation need to you meet the exemption requirements. The complying with will certainly not undergo Vacant Residence Tax: Quality made use of as Continued a by the proprietor, his/her member of the family, or various other allowed inhabitant like a renter for a minimum of six months of the 2018 year will be exempt.

The building fulfills among the adhering to exceptions The Vacant Houses Tax obligation just uses to Class 1 why not look here Residential residential or commercial properties within the city of Vancouver. If your home lies in a town that does not fall within the city of Vancouver, such as the University Endowment Lands, Burnaby or Surrey, the tax obligation will certainly not apply., the Vacant Residence Tax obligation only puts on homes that are located in the City of Vancouver where as Conjecture Tax is provincial and puts on all buildings situated in taxable regions in BC.A Vacant Houses Tax residential or commercial property status declaration is needed for each and every parcel of Course 1 home and also just one registered proprietor can send the declaration.

More About Empty Home Tax Bc

A few of the major exemptions are pointed out listed below. My residential or commercial property was vacant for even more than six months since my lessee was residing in a medical facility, long term care or helpful carefacility; nevertheless, they have actually been making use of the property as a primary house * This exception does not use to 2nd homes that are used sometimes to get clinical treatment in Vancouver.

This exception is not enabled greater than two consecutive tax years, My building was unoccupied for greater than 6 months due to the fact that it is undertaking a significant renovation. Would certainly I be excluded from the Vacant Residence Tax? I own a vacant land that has been unoccupied for greater than 6 months because it is undergoing a redevelopment.